When the term of a car lease comes to an end, the lessee is left with a decision: return the car to the dealer or buy it out.

If the lessee decides to buy the car, they may have the option to purchase it outright or finance the purchase. However, in some cases, the dealer may also express interest in buying the leased car from the lessee.

In situations where the dealer wants to buy the leased car, the lessee may wonder if this is a good deal or not.

The answer depends on various factors, including the residual value of the vehicle, fees for excessive mileage or wear-and-tear, and the current market value of the car.

It is important for the lessee to do their research and compare offers from the dealer with offers from other potential buyers before making a decision.

Overall, the decision to sell a leased car to the dealer should be made after careful consideration of all options. This article will explore the reasons why a dealer may want to buy a leased car, the pros and cons of selling to a dealer, and how to negotiate a fair price.

Understanding Lease Buyout

As per Investopedia, leasing a car is a popular option for those who want to have a new car without having to purchase it outright.

However, when the lease expires, the lessee has a few options to consider. One of these options is a lease buyout. This section will cover the basics of car leasing, what a lease buyout is, and the different lease buyout options.

Basics of Car Leasing

When someone leases a car, they are essentially renting it for a set period of time, typically two to three years.

During this time, the lessee is responsible for making monthly payments to the leasing company. These payments cover the depreciation of the vehicle during the lease term, as well as any fees and interest charges.

What Is a Lease Buyout?

A lease buyout is when the lessee decides to purchase the vehicle at the end of the lease term. This can be a good option for those who have grown attached to the car or who have put a lot of miles on it and don’t want to pay the excess mileage fees.

The purchase price is typically determined by the residual value of the vehicle, which is the estimated value of the car at the end of the lease term.

Lease Buyout Options

There are two types of lease buyout options: early buyout and lease-end buyout. An early buyout is when the lessee decides to purchase the vehicle before the lease expires.

This can be a good option if the lessee wants to keep the car for an extended period of time or if they want to avoid any potential fees associated with turning in the car early.

A lease-end buyout is when the lessee decides to purchase the vehicle at the end of the lease term. This can be a good option if the lessee has grown attached to the car or if they have put a lot of miles on it and don’t want to pay the excess mileage fees.

The purchase price is typically determined by the residual value of the vehicle, which is the estimated value of the car at the end of the lease term.

In conclusion, a lease buyout can be a good option for those who want to keep their leased car. There are two types of lease buyout options: early buyout and lease-end buyout. The purchase price is typically determined by the residual value of the vehicle.

The Dealer’s Perspective

Why Dealers Want Your Leased Car

From a dealer’s perspective, purchasing a leased car can be a profitable move. When a lease ends, the dealership that leased the car is given the option to buy it from the leasing company at the residual value, which is typically lower than the car’s market value.

This means that the dealer can purchase the car for less than what they could sell it for on the market, giving them an opportunity to make a profit.

Furthermore, buying a leased car is often less risky for dealerships than buying used cars from private sellers.

Leased cars are typically well-maintained and have low mileage, making them desirable to potential buyers. In addition, dealerships have access to the car’s maintenance and repair history, which can help them determine the car’s condition and value.

Benefits for the Dealership

There are several benefits for dealerships when they buy leased cars. First, it helps them maintain a steady inventory of cars to sell. This is especially important in today’s market conditions, where there is a chip shortage that has limited production and resulted in a shortage of new cars.

By buying leased cars, dealerships can ensure that they have a diverse selection of cars to offer their customers.

Second, buying leased cars can help dealerships trade inventory with other dealerships. This is known as a dealer trade and can be beneficial for both dealerships involved.

For example, if a dealership has an excess of SUVs but a shortage of sedans, they can trade a leased sedan for an SUV with another dealership.

Overall, dealerships have a strong incentive to buy leased cars. It allows them to maintain a steady inventory of cars, trade inventory with other dealerships, and make a profit by purchasing cars at a lower price than they can sell them for on the market.

Financial Considerations

When considering whether to sell or buy out a leased car, there are several financial factors that should be taken into account. In this section, we will explore some of the most important financial considerations to keep in mind.

Calculating Your Lease Buyout Price

As per Car and Driver, the lease buyout price is the amount of money you will need to pay to purchase your leased car. This price is typically calculated as the residual value of the vehicle, plus any fees for excessive wear and tear or mileage.

To get an accurate estimate of your lease buyout price, you should contact your leasing company or consult your lease agreement.

Understanding Residual Value

Residual value is the estimated value of your leased car at the end of the lease term. This value is determined by the leasing company and is based on factors such as the make and model of the car, its condition, and its mileage.

When deciding whether to buy out your lease, it is important to consider the residual value of the vehicle, as this will affect the buyout price.

Sales Tax and Fees

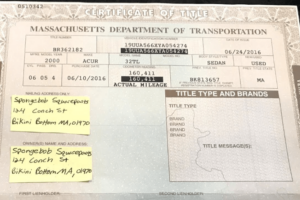

When you buy out your leased car, you will be responsible for paying sales tax and any other fees associated with the purchase.

These fees may include a purchase option fee, state taxes, and extra fees for things like title transfer and registration. It is important to factor these costs into your decision-making process, as they can add up quickly.

In addition to these financial considerations, it is important to keep in mind any penalties or fees associated with ending your lease early.

Depending on the terms of your lease agreement, you may be charged an early termination fee or other penalties if you choose to buy out your lease before the end of the term.

Overall, when considering whether to buy out your leased car, it is important to carefully weigh the financial pros and cons. By taking into account factors like the buyout price, residual value, sales tax, and fees, you can make an informed decision that is right for your budget and your needs.

Evaluating Market Value

When considering a lease buyout, it’s important to evaluate the market value of the vehicle. This will help the lessee determine if the buyout price is fair and reasonable. Here are a few factors to consider when evaluating market value.

Current Market Trends

One way to evaluate market value is to research current market trends. This can be done by looking at recent sales data for similar vehicles in the same geographic area. Online marketplaces such as Autotrader and Cars.com can provide valuable insights into current market trends.

Vehicle Appraisal Tools

Another way to evaluate market value is to use vehicle appraisal tools such as Kelley Blue Book, Edmunds, and TrueCar.

These tools can provide estimated values based on factors such as the vehicle’s make, model, year, mileage, and condition. It’s important to note that these values are estimates and may not reflect the actual market value of the vehicle.

When using appraisal tools, it’s important to consider the different values provided. For example, Kelley Blue Book provides three different values: trade-in value, private party value, and retail value.

The trade-in value is what a dealer would offer for the vehicle in a trade-in situation, while the private party value is what a private party would pay for the vehicle. The retail value is what a dealer would sell the vehicle for on their lot.

Overall, evaluating market value is an important step in determining if a lease buyout is a good decision. By researching current market trends and using vehicle appraisal tools, the lessee can make an informed decision about the buyout price.

Negotiating Your Buyout

If you have decided to buy out your leased car, you may be wondering if there is any room for negotiation. The answer is yes, but negotiating a lease buyout can be tricky. In this section, we will discuss some negotiation strategies and tips for dealing with dealers.

Negotiation Strategies

Before you start negotiating with the dealer, it is important to do your research. Find out the current market value of your car and compare it to the residual value stated in your lease agreement. If the residual value is higher than the market value, you may have some room for negotiation.

One strategy is to negotiate the purchase price of the car. You can try to get the dealer to lower the purchase price to the market value of the car.

This may be difficult, as the dealer has already calculated the residual value of the car at the beginning of the lease agreement. However, if the dealer is motivated to make a sale, they may be willing to negotiate.

Another strategy is to negotiate the interest rate on the financing. If you are financing the buyout, you can try to get a lower interest rate from the dealer or your bank. This can save you money in the long run.

Dealer Negotiations

When negotiating with the dealer, it is important to be confident and knowledgeable. Show the dealer that you have done your research and that you know the market value of the car. Be clear about what you want and what you are willing to pay.

One tip is to negotiate with multiple dealers. This can give you more leverage and help you get a better deal. You can also try to negotiate with the dealer where you leased the car. They may be more willing to work with you since they already have a relationship with you.

Finally, be prepared to walk away if you cannot get a good deal. There are other options, such as buying a used car or leasing a new car, that may be more affordable. Don’t let the dealer pressure you into making a decision that you will regret later.

To Wrap Up

In conclusion, selling a leased car to a dealership can be a great option for those who are looking to get out of their lease early or those who want to avoid paying any end-of-lease fees.

However, it’s important to do your research and understand the terms of your lease agreement before making any decisions.

If you decide to sell your leased car to a dealership, make sure to negotiate the price and shop around to get the best offer. Keep in mind that the dealership may try to offer you a lower price than what your car is worth, so it’s important to know the value of your car before negotiating.

Additionally, if you have any outstanding fees or charges on your lease agreement, make sure to pay them off before selling your car to a dealership. This will ensure that the transaction goes smoothly and that you receive the full value of your car.

Overall, selling a leased car to a dealership can be a convenient and hassle-free option for those who want to get out of their lease early. By following the tips and advice outlined in this article, you can make sure that you get the best deal possible and avoid any potential pitfalls along the way.

![Honda Brake Fluid [What You Need to Know] Honda Brake Fluid](https://roadsumo.com/wp-content/uploads/2022/02/Honda-brake-fluid-150x150.jpg)

![Read more about the article License Plate Owner Lookup for Free [How to Find the Owner]](https://roadsumo.com/wp-content/uploads/2022/03/license-plate-owner-lookup-for-free-300x200.jpg)